The housing society accounting service gap is real!

Routine accounting is obsolete, and compliance isn’t optional.

With structured housing laws becoming mandatory and resident expectations rising, the role of Accounting Service Providers (ASPs) moves far beyond routine monthly maintenance and billing. ASPs now play a critical role in building and maintaining financial frameworks essential for all communities and cooperative housing societies.

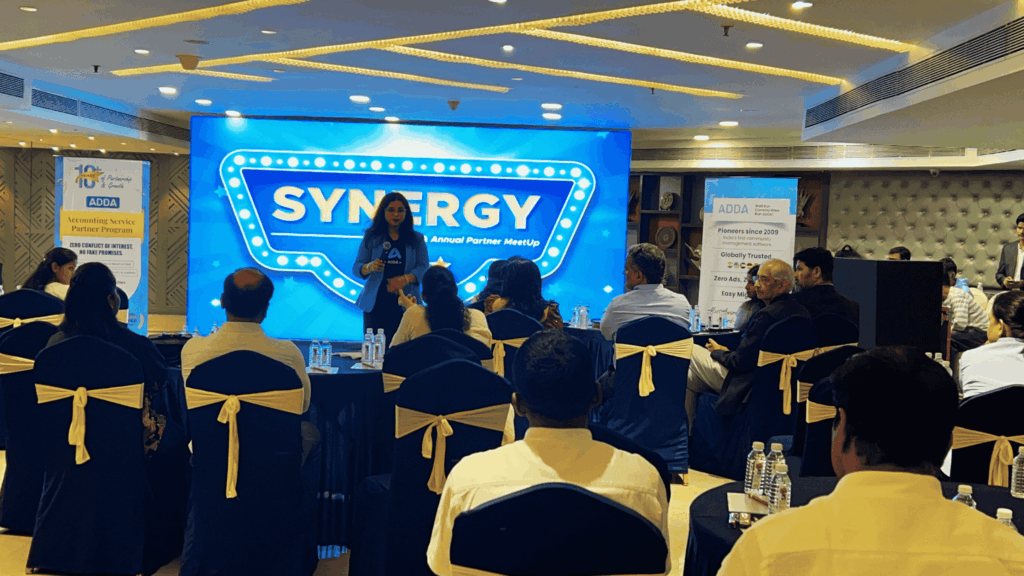

Synergy 2025, hosted by ADDA on 3rd December 2025 at Hotel Sahara Star, Mumbai, was a celebration of this evolving industry and a recognition of the important role ASPs play in shaping the housing society accounting industry in Maharashtra.

This year’s Synergy brought together more than 100 partners and industry experts, marking a milestone of 10+ years of partnership with ADDA.

Accounting Service Providers (ASPs) work goes far beyond bookkeeping; they ensure accuracy, legal compliance, ethical financial management, and trust among resident communities. With Maharashtra’s stringent accounting regulations, rising digital billing and payment operations, and increasing resident expectations, the housing accounting industry is evolving faster than ever. And ASPs are driving that transformation.

Table of Contents

A Sector at Scale and Under Compliance Pressure

Maharashtra is home to a standardised cooperative housing accounting legislative framework in India. The Maharashtra Cooperative Societies Act, 1960, still remains the only standardised cooperative housing law in the country, defining governance, financial accuracy, billing and audit requirements, and operational accountability for all registered societies.

As of 2025, an estimated 70,000 housing societies in the state fall under the GST regime, significantly amplifying the need for accounting practices that need to adhere to the law. The shift to GST compliance has introduced structured invoicing, tracking audit trails, and factual financial reporting as non-negotiable expectations for all ASPs.

For thousands of cooperative societies that need to operate under these laws, the role of ASPs has evolved from bookkeeping, billing, and reporting to checking invoicing compliance, process integrity, and financial governance. Accounting Service Providers (ASPs) now influence how societies build trust, resolve disputes, avoid legal exposure, and plan long-term finances.

The New Reality: Scale Meets Complexity

Many Accounting Service Providers (ASPs) today support from a handful of small communities to large housing societies. Managing this volume demands precision, discipline, and a digital platform that eliminates human error. Accounting Service Providers (ASPs) now have to ensure:

- GST-compliant invoicing

- Auditable reporting

- Maintenance billing accuracy

- Accounting Ledger Management

- Digital payment reconciliation

- Year-end audits and statutory submissions

Conventionally, much of this work was manual, error-prone, and time-consuming, not to mention the inconsistency across clients.

Moving forward, housing society accounting demands something different, like ADDA Books, which provides billing and reporting automation, compliance invoicing, and transparency.

ADDA as ASPs’ Preferred Digital Platform

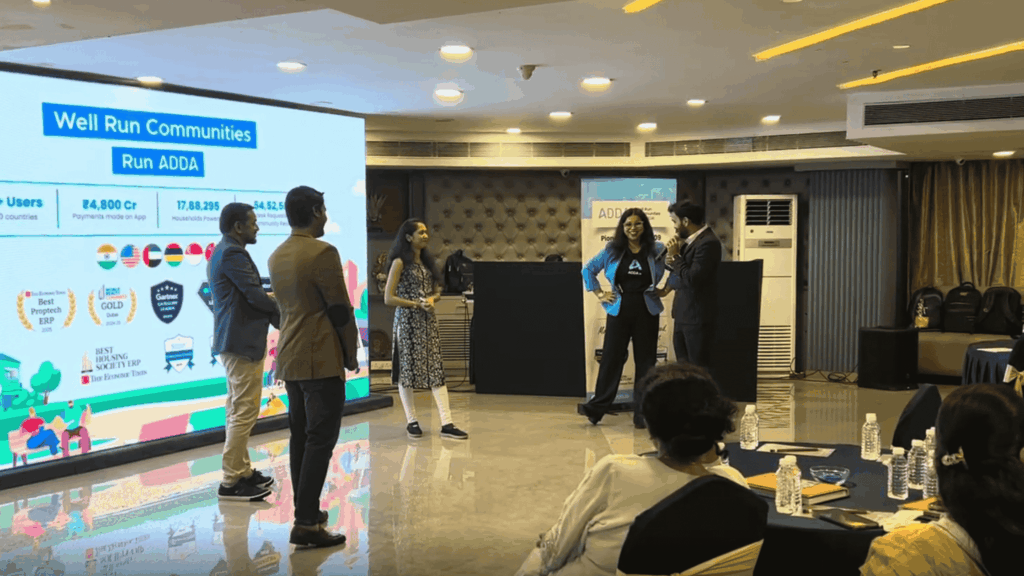

Over the last decade, ADDA has emerged as an important bridge to the crucial gaps in the housing society accounting industry.

ADDA’s platform empowers ASPs with a digital-first, compliance-adherent accounting software built especially for Accounting Service Providers (ASPs).

The platform ensures accuracy at scale for automated billing, arrears tracking, GST-compliant invoicing, digital ledgers, live dashboards, and audit-ready data trails, and governance management without administrative strain.

Over 90 cities in India currently operate through ADDA via Accounting Service Providers, with many large accounting partners seamlessly managing 100+ communities through the platform.

Through the digital accounting platform’s features like cloud access, automated billing and invoicing, MIS reporting, and structured compliance logs, ADDA makes sure societies stay audit-ready, financially transparent, and legally aligned.

Synergy 2025: From Networking to Sector-Wide Alignment

One of the biggest challenges faced by Accounting Service Providers in Maharashtra was operating in silos and isolation, disconnected peers, and limited opportunities for shared learning.

Synergy 2025 sought to change that with collaborative discussions with peers and industry experts. The event gave a unified understanding of modern accounting practices for housing societies.

A recurring theme throughout the conversations was clear: Compliance and digital governance are no longer optional. They define the Accounting Service Providers (ASPs) industry.

Conclusion

Celebrating ADDA’s ASP network, which was built over 10 years of collaboration, Synergy 2025 was more than an industry event that paved the way for a new era. From working independently to operating as a connected community, Accounting Service Providers are stepping into a future where compliance, accounting automation, and collaboration define excellence.

As ADDA continues supporting this transition, one message remains constant:

When technology, regulation, and expertise work together, transparency isn’t a target. It becomes the default.